Maximise Your Benefits

Maximise Your Benefits

If you are a new OMEGS member or just new at getting to know your benefits there are a couple of things you can do to maximise your chance of having a comfortable retirement.

Please see the Contributions section to find out how you can save as much as possible.

We know that it’s obvious – but it’s still worth saying: The longer you save, the more you will have. Ideally, you need to aim to save for at least 40 years to make sure that you will have enough to be able to maintain your standard of living in retirement! This means three things:

- Start saving early. You are never too young to start saving for your retirement – and in fact, the savings you make in your twenties will make up the largest part of your capital on the day you retire!

- Make sure you preserve your savings when you change employment. It can be very tempting to take your benefit in cash when you change employment. We have two words for you: Please don’t! By transferring your retirement savings to SuperFund Preserver, a preservation fund, an RA fund or your new employer’s fund, you can help to build up your 40 years of saving – rather than having to start again from scratch!

- Consider working for longer. Just because Old Mutual’s “Normal Retirement Age” is 61, doesn’t mean that you will automatically have enough saved up when you get to 61. (By the way: Old Mutual employees may actually extend their retirement beyond 61, provided that both you and your Line Manager agree to extend the Contract of Employment on an annual basis. The maximum age until which a contract can be extended is 65). We recognise that this is an emotive issue, especially if you aren’t granted an contract extension beyond 61. We can only encourage you to start planning as early as possible, and to make alternative plans if appropriate. You may also wish to consider the SuperFund Deferred Retirement option, if you will continue working and earning an income after you retire from Old Mutual

When you leave Old Mutual, there are several ways to make sure that your retirement savings continue growing:

- Leave your savings in SuperFund Preserver: You can leave your savings in SuperFund without have to take any action! You will have access to a very similar range of investment portfolios. Read more about the Preserver option here.

- Transfer your savings to a Preservation Fund

- Transfer your savings to a Retirement Annuity (RA) Fund

- Transfer your savings to your new employer’s retirement fund

For more detail, please see the section about leaving Old Mutual.

By going for a simple medical test, you may be able to double your life cover (depending on your age)! Find out more about your Life Cover benefit, or read our handy Full Cover application guide to find out how to increase your cover.

You can choose from a range of investment portfolios, which may be suited to different circumstances and preferences. Read more about your investment options here.

You should start thinking and planning about your retirement strategy several years before you actually retire. The choices that you make at retirement will affect your finances for the rest of your life, so it is critical for you to get the decision right! You can read more about your retirement options here.

Speaking to a financial advisor can be a huge help to understand your finances better. Did you know that you can get tailor-made financial advice from a select group of accredited Old Mutual financial advisors who have had training on the specifics of OMEGS and its benefits?

Alternatively, if you already have a relationship with a licensed financial advisor that you trust, then we encourage you to maintain that relationship.

How do you know whether you are on track for retirement? If you’re getting closer to retirement, you may not really want to know the answer, in case it scares you. And if you’re still far from retirement, you may think it’s not really important right now. But wherever you are on the journey, knowing your Retirement Planning Status can equip you to make better decisions and take appropriate action. Your Retirement Planning Status provides you with an indication of how “on-track” you are for a comfortable retirement.

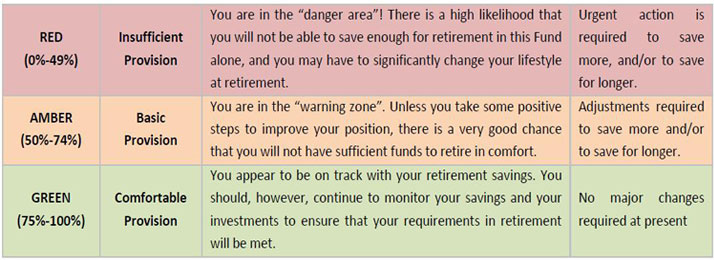

All this information is available in your latest Member Benefit Statement. If you haven’t seen yours, check it out on Secure Services. In your Benefit Statement, we’ve colour-coded your Retirement Planning Status to give you a quick indicator of how “on-track” you are for a comfortable retirement. This table provides an idea of what we mean:

Your Retirement Planning Status is calculated using a measure called a Replacement Ratio (sometimes abbreviated as “RR”). It can be calculated as your Projected monthly pension at retirement divided by your Projected monthly salary at retirement.

For example: if our friend Average Joe has pensionable earnings of R10,000 a month just before he retires, a Replacement Ratio of 65% would mean that he will receive a pension of R6 500 per month (65% of R10 000) in his retirement.

A couple of important things to note:

- The Replacement Ratio that you require at retirement may be very different from that which your colleagues require, because it will depend on your personal circumstances. However, if you want to retire comfortably, you will probably need a total savings pool which will give you a pension after retirement that is at least 75% of your income just before retirement.

- We do not know anything about other money or investments you may have saved towards your retirement, so we have based our analysis ONLY on your savings in this Fund.

Please get in touch with your Fund at ebstafffundben@oldmutual.com at the end of the month of the appointment, requesting your membership and Fund details, or phone the Call Centre (0860 20 30 40) for assistance if you would like to transfer your savings from another retirement fund into SuperFund.