Investment Management Fees

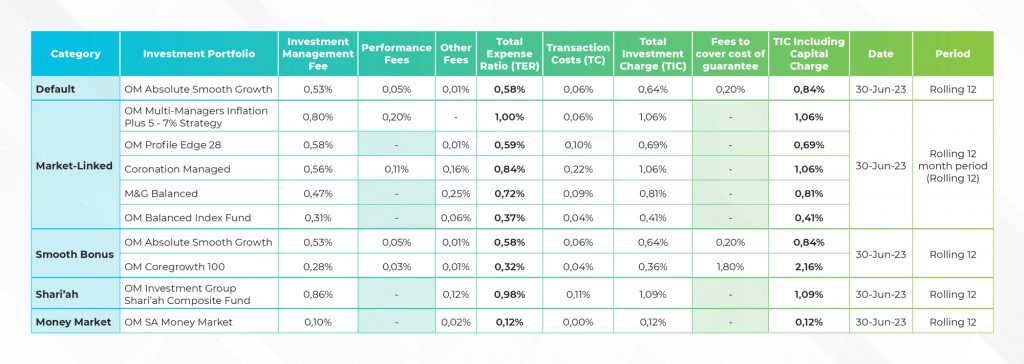

The table below gives typical investment management fees.

Investment fee examples

Based on the table of typical investment management fees set out above, it is possible to provide a few examples of how the investment management fees would impact on your retirement savings. Note that all of these fees may vary if the assumptions set out in the table above differ, although it is not expected that fees will be significantly different to those set out above.

Example 1: A member fully invested in Old Mutual Absolute Smooth Growth

- If you chose to invest your full Member Account Balance in the Absolute Smooth Growth Portfolio, then your retirement savings would incur a total investment fee of approximately 0.73% per year, taking into account all investment-related fees including the capital charge.

- Put differently, if you have a Member Account Balance of R100,000, then investment fees will reduce your investment return by R730 per year.

- (Note that the capital charge of 0.2% is deducted before the declaration of the bonus (investment return) each month. This means that, if you want to compare the net-of-fees investment return of the Absolute Smooth Growth Portfolio against another portfolio, you should only deduct the Investment Management Charge plus the Administration Charge (i.e. a total of 0.53%) from the Absolute Smooth Growth Portfolio’s return.)

Example 2: A member fully invested in Coronation Managed

- If you chose to invest your full Member Account Balance in the Coronation Managed portfolio, then your retirement savings would incur an investment management fee that could range between 0.63% and 1.83%. The fee depends on whether the Coronation portfolio outperforms its benchmark (target) – if it does not outperform the targets at all, then the fee would be 0.63%, but if it does extremely well then the fee could be as high as 1.83%.

- Put differently, if you have a Member Account Balance of R100,000, then investment fees will reduce your investment return by between R630 and R1,830 per year.

Example 3: A member invested with a 50/50 split between OMIG Profile Edge28 and Prudential Global Balanced

- If you chose to invest half of your Member Account Balance in OMIG Profile Edge28 and half in Prudential Global Balanced, then your retirement savings would incur an investment management fee based on the combination of these products’ fees. The total investment management fee would be approximately 0.63% per year.

- Put differently, if you have a Member Account Balance of R100,000, then investment fees will reduce your investment return by approximately R630 per year.

Example 4: A member fully invested in Old Mutual Coregrowth 100 Portfolio

- If you chose to invest your full Member Account Balance in the Coregrowth 100 Portfolio, then your retirement savings would incur a total investment fee of approximately 2.1% per year, taking into account all investment-related fees including the capital charge.

- Put differently, if you have a Member Account Balance of R100,000, then investment fees will reduce your investment return by R2,100 per year.

- (Note that the capital charge of 1.8 % is deducted before the declaration of the bonus (investment return) each month. This means that, if you want to compare the net-of-fees investment return of the Coregrowth Portfolio against another portfolio, you should only deduct the Investment Management Charge plus the Administration Charge (i.e. a total of 0.3%) from the Coregrowth Portfolio’s return.)