Contributions

Contributions

You are able to make tax-deductible retirement fund contributions of up to 27.5% of the greater of your remuneration and taxable income. Annual tax deductions are limited to R350 000.

Old Mutual has introduced greater flexibility to enable you to change your contribution rate towards your retirement savings as and when your personal circumstances change. Going forward, you will be able to update your contribution rate on a monthly basis via Workday. Changes need to be made from the 1st to 7th of the month in order for the new contribution rate to apply for that month. Changes may also be made after the 7th of the month; these would only apply to the following month.

You can access our step-by-step guide on how to make changes to your contributions.

If you have any queries, please log a case via Workday Help. You can access our step-by-step guide on how to log a case via Workday Help.

Your contribution options in respect of your Old Mutual salary depend on whether you are an “Office Staff” employee (i.e. on a Total Guaranteed Package pay structure) or a “Field Staff” employee (i.e. on a non-TGP pay structure that includes some commission component).

New contribution categories as from 1 April 2022

| Office Staff | 30.0% or 35.0% of TGP (Employer Contribution: 3.5%) |

| Field Staff | 31.5% or 26.5% of pensionable earnings (Employer Contribution: 12.0%) |

Note: The above percentages are fixed.

Please select the appropriate option below.

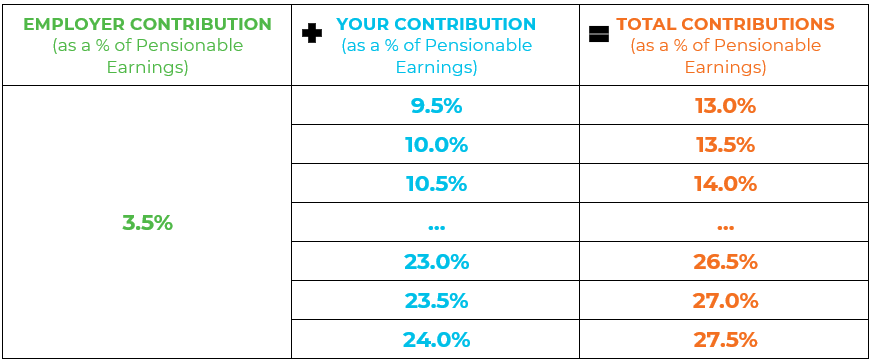

Contributions for Office Staff are based on your full TGP. (In other words, your Pensionable Earnings equals your TGP). There is an Employer contribution of 3.5% of your TGP. You can set your Member contribution between 9.5% and 24.0% of your TGP. (Note that for Office Staff, your TGP includes the Employer contribution. The distinction between Employer and Employee contribution is primarily a practical issue related to benefits such as disability cover). The options are summarised in the table below:

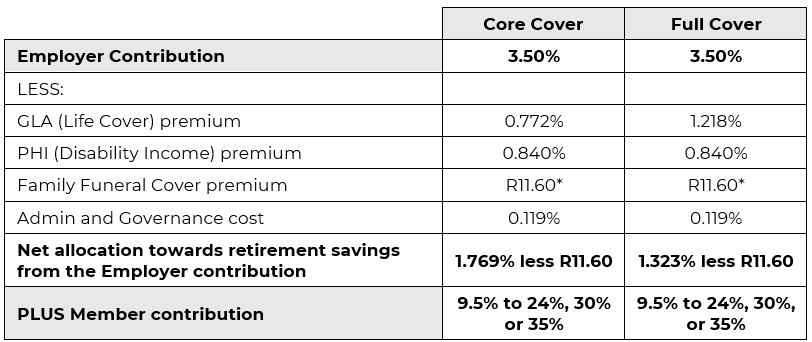

Contribution breakdown for Office Staff (as a percentage of Pensionable Earnings)

Following the most recent review, as at 1 April 2025, the deductions in respect of Life Cover (GLA), Administration and Governance costs, Disability Income Cover (PHI) and Family Funeral Cover, are shown below:

*Reviewed 1 July each year.

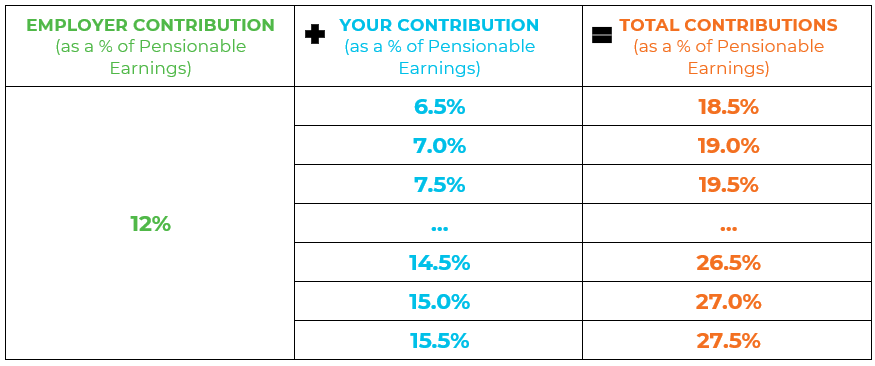

Contributions for Field Staff are based on your Pensionable Earnings (PEAR), which is calculated using a special formula for each business unit. There is an Employer contribution of 12.0% of your Pensionable Earnings. You can set your Member contribution between 6.5% and 15.5% of your TGP. The options are summarised in the table below:

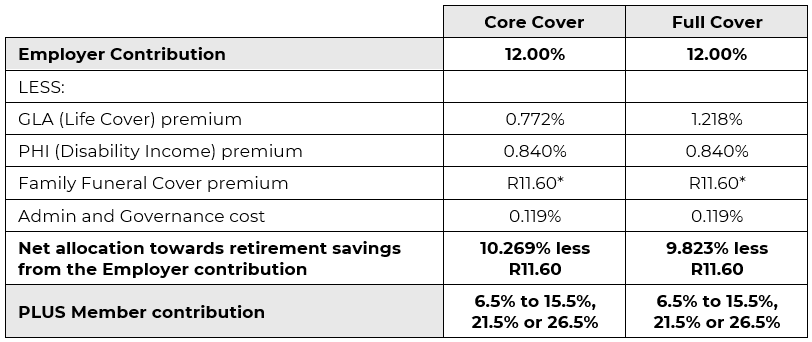

Contribution breakdown for Field Staff (as a percentage of Pensionable Earnings)

Following the most recent review, as at 1 April 2025, the deductions in respect of Life Cover (GLA), Admin & Governance Costs, Disability Income Cover (PHI) and Family Cover, are shown below:

*Reviewed 1 July each year

We know that increasing your contribution rate isn’t easy, especially when times are tight! But even a small change can make a big difference. For example, each year at pay review time, try to increase your retirement contribution by 0.5%. You will hardly notice the impact on your take-home pay, but over the long time the impact is huge!

EXAMPLE: Thato, with a TGP of R10 000 per month

Each year at pay review time, Thato increases his OMEGS contribution rate by 0.5%, and he does this for the next 10 years. After 10 years, his contribution rate is 5% higher than it is at present. Thereafter, he keeps his contribution rate level.

- After 10 years, Thato’s savings would be equivalent to R40,700 higher in today’s Rand value than they would have been if he had not made the increases.

- After 20 years, Thato’s savings would be equivalent to R154 200 higher in today’s Rand value.

- After 30 years, Thato’s savings would be equivalent to R350 900 higher in today’s Rand value.

- After 35 years, Thato’s savings would be equivalent to R496 700 higher in today’s Rand value.

By simply increasing his contribution rate by 0.5% each year for the next 10 years, Thato would have saved an extra 4.1 times his annual TGP after 35 years!

Best of all, Thato’s extra R496 700 after 35 years would have cost him less than R175 500 in terms of take-home pay (in today’s Rand value). This is because of the benefits of compound interest and tax deductions.

Note: these calculations are for illustrative purposes only, and are based on a set of assumptions which may not play out in future.

We are very aware that there are many opportunities for you to save outside OMEGS, and we strongly encourage members to save as much as they can! A couple of things to remember:

- A skilled and trustworthy financial adviser can be a great help so you can find the optimal way to structure your savings, and to ensure you are saving sufficiently to meet your financial goals.

- You could consider an RA (Retirement Annuity) or a Unit Trust investment from a reputable investment manager if you want to save outside OMEGS, although there are also many other options which may also suit your needs.

- If you are saving specifically for your retirement, consider using all of the opportunities to maximise your savings in OMEGS before you start saving outside OMEGS, because OMEGS is likely to be more cost-effective and tax-efficient than many external options.