Investment Overview

Your Member Account Balance needs to be invested to grow over the long term, so that you can benefit from the power of compound interest. It is important to have a long-term investment strategy which targets growth well in excess of inflation; otherwise you are unlikely to be able to save enough to provide for your needs in retirement.

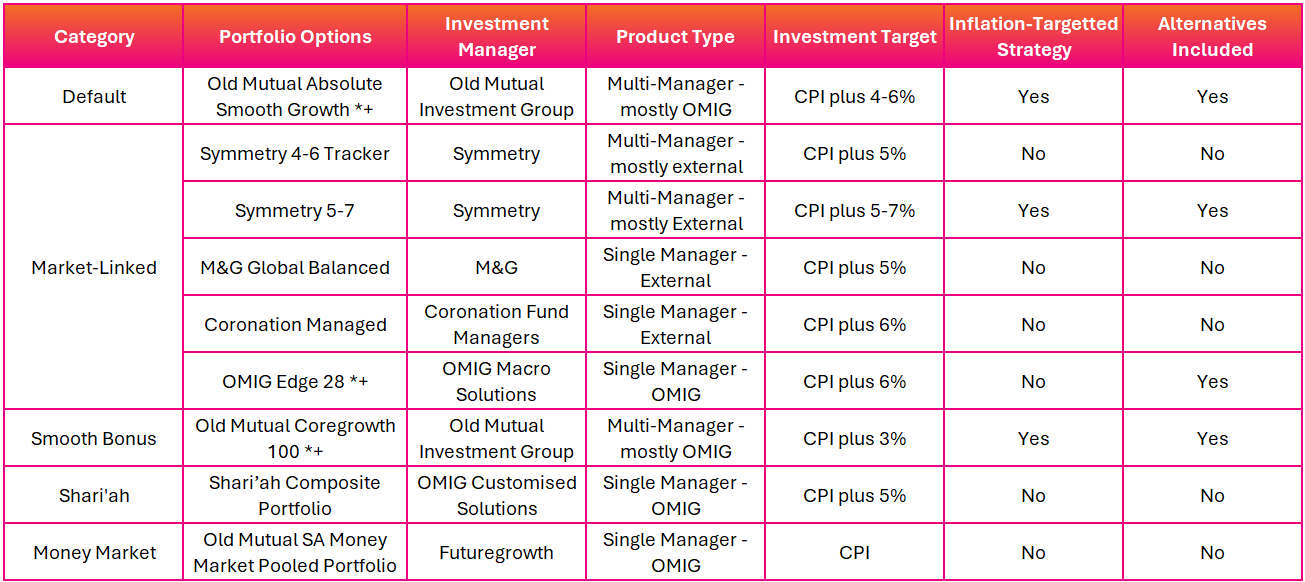

- The OMEGS section in SuperFund provides members with an excellent default option, because many members are not completely confident when making investment choices. This JMC Choice default option is a good “one-size-fits-all” investment appropriate for the needs of the majority of OMEGS members. If you don’t actively make an investment choice, you will be invested in the JMC Choice option, the Old Mutual Absolute Smooth Growth Portfolio.

- If you want to tailor-make your investment strategy, you can choose from any one or more of the 9 carefully selected investment portfolios on offer.

- You will pay the relevant investment management fees on the investment(s) you select.

- Please make sure you understand the potential for Market Value Adjuster (MVA) if you switch out of the Old Mutual Absolute Smooth Growth Portfolio or the Old Mutual Absolute Secure Growth Portfolio. You can read more about this in the section “Understanding the Absolute Growth Portfolios (AGP) and Market Value Adjustments” below.

The Fund aims to outperform the STeFI 3-month Index per annum over a rolling 12-month period.

The targeted long-term return targets for all of the non-smooth bonus portfolios are the midpoints of the ranges specified above. The smooth bonus portfolios have their official targets (gross of fees and net capital charges) reflected as the maximum targeted return with the minimum targeted return being 2% lower.

Need Help?

For Investment Choice and OMEGS-related queries, contact the Member Service Centre on 0860 20 30 40.

If you would like to get in touch with an accredited Old Mutual financial adviser, you can find contact details here.