Contributions

Contributions

You are able to make tax-deductible retirement fund contributions of up to 27.5% of the greater of your remuneration and taxable income. Annual tax deductions are limited to R350 000.

Old Mutual has introduced greater flexibility to enable you to change your contribution rate towards your retirement savings as and when your personal circumstances change. Going forward, you will be able to update your contribution rate on a monthly basis via Workday. Changes need to be made from the 1st to 7th of the month in order for the new contribution rate to apply for that month. Changes may also be made after the 7th of the month; these would only apply to the following month.

You can access our step-by-step guide on how to make changes to your contributions.

If you have any queries, please log a case via Workday Help. You can access our step-by-step guide on how to log a case via Workday Help.

Your contribution options in respect of your Old Mutual salary depend on whether you are an “Office Staff” employee (i.e. on a Total Guaranteed Package pay structure) or a “Field Staff” employee (i.e. on a non-TGP pay structure that includes some commission component).

New contribution categories as from 1 April 2022

| Office Staff | 30.0% or 35.0% of TGP (Employer Contribution: 3.5%) |

| Field Staff | 31.5% or 26.5% of pensionable earnings (Employer Contribution: 12.0%) |

Note: The above percentages are fixed.

Please select the appropriate option below.

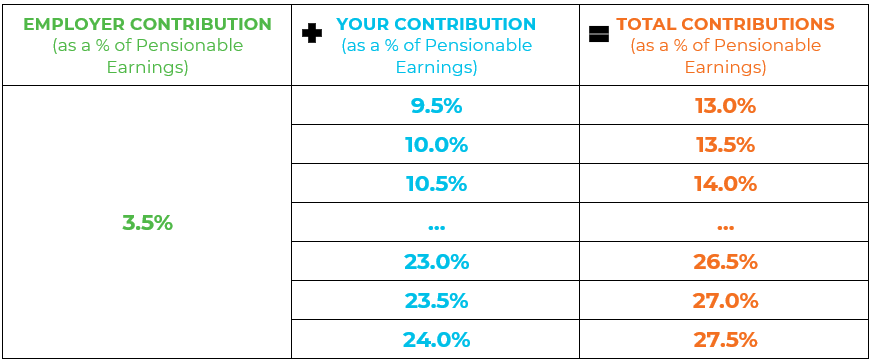

Contributions for Office Staff are based on your full TGP. (In other words, your Pensionable Earnings equals your TGP). There is an Employer contribution of 3.5% of your TGP. You can set your Member contribution between 9.5% and 24.0% of your TGP. (Note that for Office Staff, your TGP includes the Employer contribution. The distinction between Employer and Employee contribution is primarily a practical issue related to benefits such as disability cover). The options are summarised in the table below:

Contribution breakdown for Office Staff (as a percentage of Pensionable Earnings)

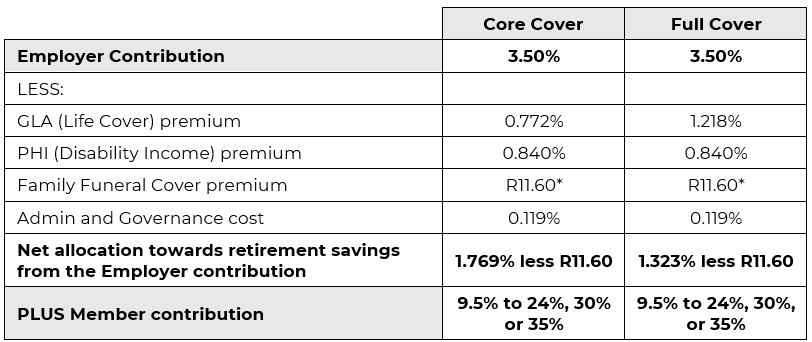

Following the most recent review, as at 1 April 2025, the deductions in respect of Life Cover (GLA), Administration and Governance costs, Disability Income Cover (PHI) and Family Funeral Cover, are shown below:

*Reviewed 1 July each year.

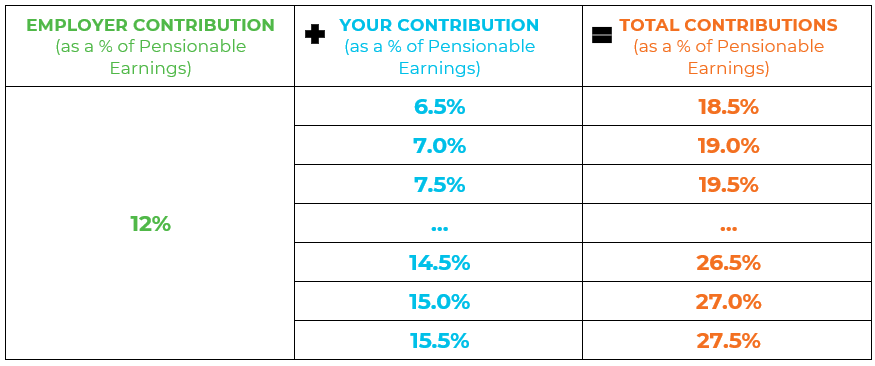

Contributions for Field Staff are based on your Pensionable Earnings (PEAR), which is calculated using a special formula for each business unit. There is an Employer contribution of 12.0% of your Pensionable Earnings. You can set your Member contribution between 6.5% and 15.5% of your TGP. The options are summarised in the table below:

Contribution breakdown for Field Staff (as a percentage of Pensionable Earnings)

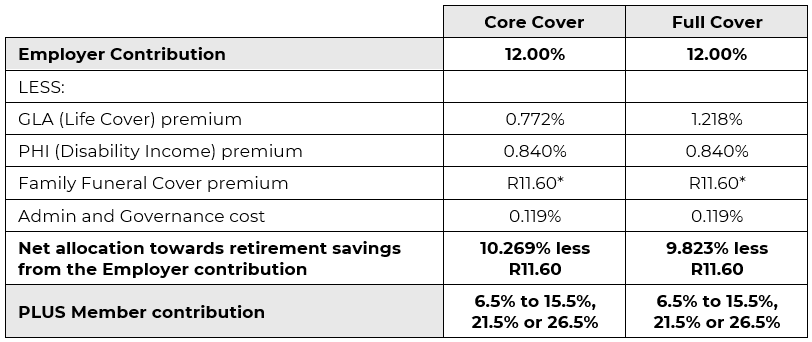

Following the most recent review, as at 1 April 2025, the deductions in respect of Life Cover (GLA), Admin & Governance Costs, Disability Income Cover (PHI) and Family Cover, are shown below:

*Reviewed 1 July each year

What is the Two-Pot Retirement System?

The Two-Pot Retirement System lets you access a limited portion of your retirement savings before retirement for financial emergencies, while protecting the majority of your savings for retirement.

From 1 September 2024, retirement savings are structured to balance flexibility today with security in the future.

What changes?

- Limited access to savings before retirement.

- Mandatory preservation of most retirement savings.

How your retirement savings are structured

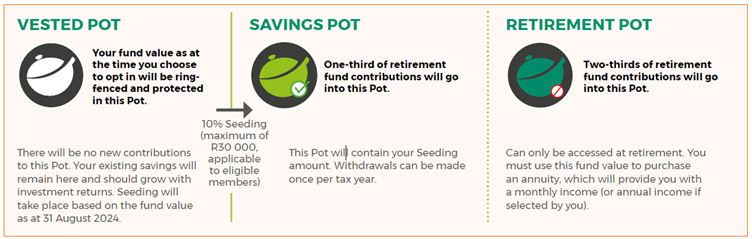

From 1 September 2024, your retirement savings are split into three Pots, all held within one Member Account.

- A once-off amount equal to 10% of your existing retirement savings, capped at R30 000, is transferred into your Savings Pot.

- All remaining savings accumulated up to 31 August 2024 are placed in the Vested Pot.

Did you know? You do not need to apply for the opening Savings Pot balance. This happens automatically.

For detailed information on the Two-Pot Retirement System, visit the Old Mutual website here.

Ongoing contributions from 1 September 2024

All future retirement contributions (after fees and risk premiums, where applicable) are split as follows:

- One-third goes into your Savings Pot.

- Two-thirds goes into your Retirement Pot.

Understanding the three Pots

Savings Pot

- Funded by one-third of future contributions.

- Can be accessed once per tax year.

- Minimum withdrawal: R2 000.

- No maximum withdrawal, limited to available balance.

- Withdrawals are subject to tax and a transaction fee.

- Withdrawals reduce the lump sum available at retirement.

Retirement Pot

- Funded by two-thirds of future contributions.

- Cannot be accessed before retirement or death.

- Must be used to buy a pension at retirement.

- Ensures long-term financial security.

Vested Pot

- Contains all retirement savings accumulated before 1 September 2024.

- Subject to the rules that applied before the Two-Pot system.

- May be accessed if you leave employment, depending on those rules.

- Continues to grow with investment returns.

- No new contributions are added.

What happens if you leave your job?

- You may access your Savings Pot (subject to annual withdrawal rules).

- You may access your Vested Pot, based on the old rules.

- You cannot access your Retirement Pot.

Tax and fees

- Savings Pot withdrawals are taxed at your marginal tax rate.

- Tax and transaction fees apply to each withdrawal.

- Any outstanding tax owed to SARS will be deducted before payment.

Using WhatsApp and digital channels

You can check your balances and request a Savings Pot withdrawal via WhatsApp.

Please ensure your cell phone number is up to date on the Old Mutual App or via the Old Mutual Portal.

You can access the Savings Pot withdrawal feature on WhatsApp. Click here for more information on this process.

Members aged 55 or older on 1 March 2021

If you were a provident fund member, aged 55 or older on 1 March 2021, and remained in the same fund, you may choose whether to opt into the Two-Pot Retirement System.

You have 12 months from 1 September 2024 to make this choice.

Important: If you transfer to another fund, you will automatically move into the Two-Pot system.

Accessing your retirement savings early

You may access your full retirement value before retirement only if:

- You become permanently disabled (subject to approval), or

- You cease South African tax residency, in line with SARS rules.

Allowable deductions

Any deductions permitted under Section 37D of the Pension Funds Act will be applied proportionately across all applicable Pots.

We know that increasing your contribution rate isn’t easy, especially when times are tight! But even a small change can make a big difference. For example, each year at pay review time, try to increase your retirement contribution by 0.5%. You will hardly notice the impact on your take-home pay, but over the long time the impact is huge!

EXAMPLE: Thato, with a TGP of R10 000 per month

Each year at pay review time, Thato increases his OMEGS contribution rate by 0.5%, and he does this for the next 10 years. After 10 years, his contribution rate is 5% higher than it is at present. Thereafter, he keeps his contribution rate level.

- After 10 years, Thato’s savings would be equivalent to R40,700 higher in today’s Rand value than they would have been if he had not made the increases.

- After 20 years, Thato’s savings would be equivalent to R154 200 higher in today’s Rand value.

- After 30 years, Thato’s savings would be equivalent to R350 900 higher in today’s Rand value.

- After 35 years, Thato’s savings would be equivalent to R496 700 higher in today’s Rand value.

By simply increasing his contribution rate by 0.5% each year for the next 10 years, Thato would have saved an extra 4.1 times his annual TGP after 35 years!

Best of all, Thato’s extra R496 700 after 35 years would have cost him less than R175 500 in terms of take-home pay (in today’s Rand value). This is because of the benefits of compound interest and tax deductions.

Note: these calculations are for illustrative purposes only, and are based on a set of assumptions which may not play out in future.

We are very aware that there are many opportunities for you to save outside OMEGS, and we strongly encourage members to save as much as they can! A couple of things to remember:

- A skilled and trustworthy financial adviser can be a great help so you can find the optimal way to structure your savings, and to ensure you are saving sufficiently to meet your financial goals.

- You could consider an RA (Retirement Annuity) or a Unit Trust investment from a reputable investment manager if you want to save outside OMEGS, although there are also many other options which may also suit your needs.

- If you are saving specifically for your retirement, consider using all of the opportunities to maximise your savings in OMEGS before you start saving outside OMEGS, because OMEGS is likely to be more cost-effective and tax-efficient than many external options.