CLOSURE OF THE OMIG PROFILE BALANCED PORTFOLIO TO OMEGS MEMBERS

- The OMEGS Joint Management Committee has recently reviewed the range of investment portfolios offered. One of the key goals was to make sure that the range of options is kept to a minimum, to reduce scope for member confusion and choice overload.

- The OMIG Profile Balanced portfolio is due to be removed from the range of options available to OMEGS members with effect from 17 May 2017.

- Members invested in the OMIG Profile Balanced portfolio are therefore requested to switch any balance held in the OMIG Profile Balanced portfolio to an alternative investment portfolio (or portfolios) prior to 17 May 2017. Members must also ensure that they change their future contributions accordingly.

- You can make the switch online via Secure Services, or by using the Investment Fax Form. There is no cost to implement an investment switch.

- If you are switching online, we recommend that you use the Microsoft Internet Explorer web browser, since the Secure Services website is optimised for this browser.

- If you do not implement a switch prior to 17 May, any balance in the OMIG Profile Balanced portfolio will be switched out automatically on 17 May. 90% of this amount will be switched into the OMIG Profile Edge 28 portfolio, and 10% of this amount will be switched into the Old Mutual SA Money Market Pooled Portfolio.

- If you do not implement a change prior to 17 May, any investment election directing future contributions to the OMIG Profile Balanced portfolio will also be automatically changed. 90% of such future contributions will be directed towards the OMIG Profile Edge 28 portfolio, and 10% of such future contributions will be directed towards the Old Mutual SA Money Market Pooled Portfolio.

- The OMEGS Joint Management Committee has selected this combination of (90% OMIG Profile Edge 28 + 10% Old Mutual SA Money Market Pooled Portfolio) as historically it has given a relatively close match to the OMIG Profile Balanced portfolio from a risk and return perspective. The OMIG Profile Edge 28 portfolio is managed by the same accomplished team who manage the OMIG Profile Balanced portfolio, and therefore investment processes and strategies overlap closely. Historic analysis shows close correlation in both returns and volatility between the selected combination and the OMIG Profile Balanced portfolio over rolling 12-month and 3-year periods. The effective investment management fee for the selected combination is also closely matched to that of the OMIG Profile Balanced portfolio. More detail comparing the selected combination against the OMIG Profile Balanced portfolio is set out below.

- You are strongly encouraged to consider which investment portfolio/s may be most suited to your particular circumstances and to actively implement a switch out of the OMIG Profile Balanced portfolio, rather than relying on the automatic switch which will happen on 17 May.

- Please consult with your trusted financial adviser if you require assistance in making an investment switch decision. If you do not have a relationship with a financial adviser, you may wish to contact an OMEGS-accredited adviser for assistance. OMEGS-accredited advisers have had training on the specific range of OMEGS benefits, and will be happy to assist you with any fund-related decisions.

ADDITIONAL DETAIL: RATIONALE AND OPTIONS

The OMEGS options include a carefully selected range of investment portfolios, spanning appropriate risk-return profiles, investment manager styles and portfolio construction approaches. In line with international research, the range is deliberately limited to a small number of options to reduce scope for member confusion and choice overload.

As part of the recent review, work was done to identify if any rationalisation could occur, so as to keep the total number of portfolios to a minimum. After extensive consideration, the JMC concluded that there were more options than necessary in the market-linked category. It was identified that there is a close overlap between the OMIG Profile Balanced portfolio and other market-linked portfolios. The JMC concluded that the OMIG Profile Balanced portfolio could be removed without materially affecting the diversity of options, thereby reducing scope for member confusion.

It is important to note that this change does not reflect any concerns regarding OMIG. The OMIG Profile Edge28 portfolio (a more dynamically-managed portfolio in the Profile range) remains as a key component of the OMEGS investment range and is managed by the same accomplished investment team.

The OMIG Profile Balanced portfolio will be removed from the range of options available to OMEGS members with effect from 17 May 2017. You are therefore requested to switch any balance held in the OMIG Profile Balanced portfolio to an alternative investment portfolio (or portfolios) prior to 17 May 2017.

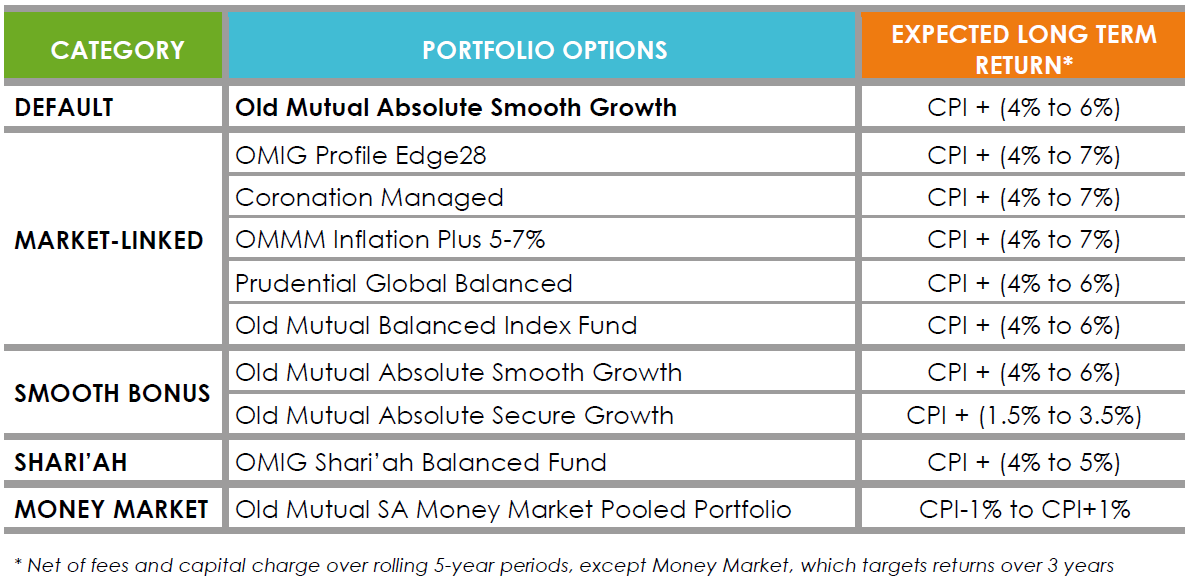

The range of options available to you is as follows:

You can find fact sheets providing details about each investment portfolio as well as details about applicable investment management fees under the investments page.

WHAT HAPPENS IF YOU DON’T IMPLEMENT A SWITCH BEFORE 17 MAY 2017?

If you have a portion of your OMEGS retirement savings in the OMIG Profile Balanced portfolio and you do not implement any changes prior to 17 May, both your balance in the OMIG Profile Balanced portfolio as well as future contributions to this portfolio will be switched automatically on 17 May. The OMEGS JMC has selected a combination of 90% OMIG Profile Edge 28 + 10% Old Mutual SA Money Market Pooled Portfolio (the “Selected Combination”) as a close match to the OMIG Profile Balanced portfolio. Any remaining balances in the OMIG Profile Balanced portfolio as well as relevant future contributions will be switched into this Selected Combination on 17 May.

Investment Team and Processes: The OMIG Profile Edge 28 portfolio is managed by the same accomplished team who manage the OMIG Profile Balanced portfolio, and therefore investment processes and strategies overlap closely.

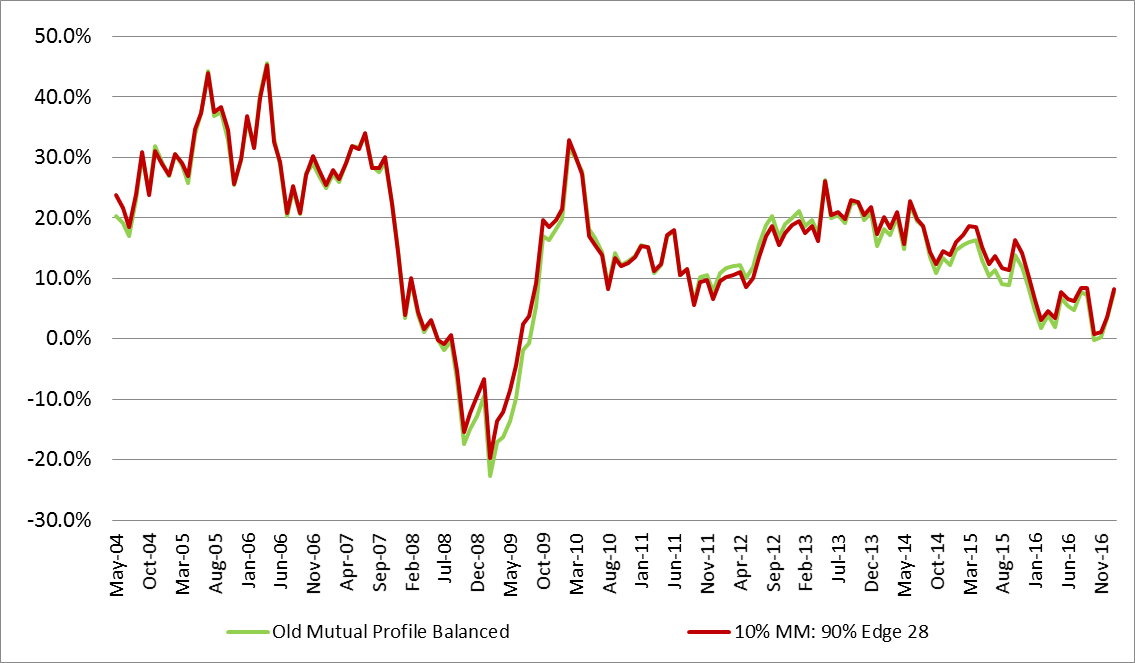

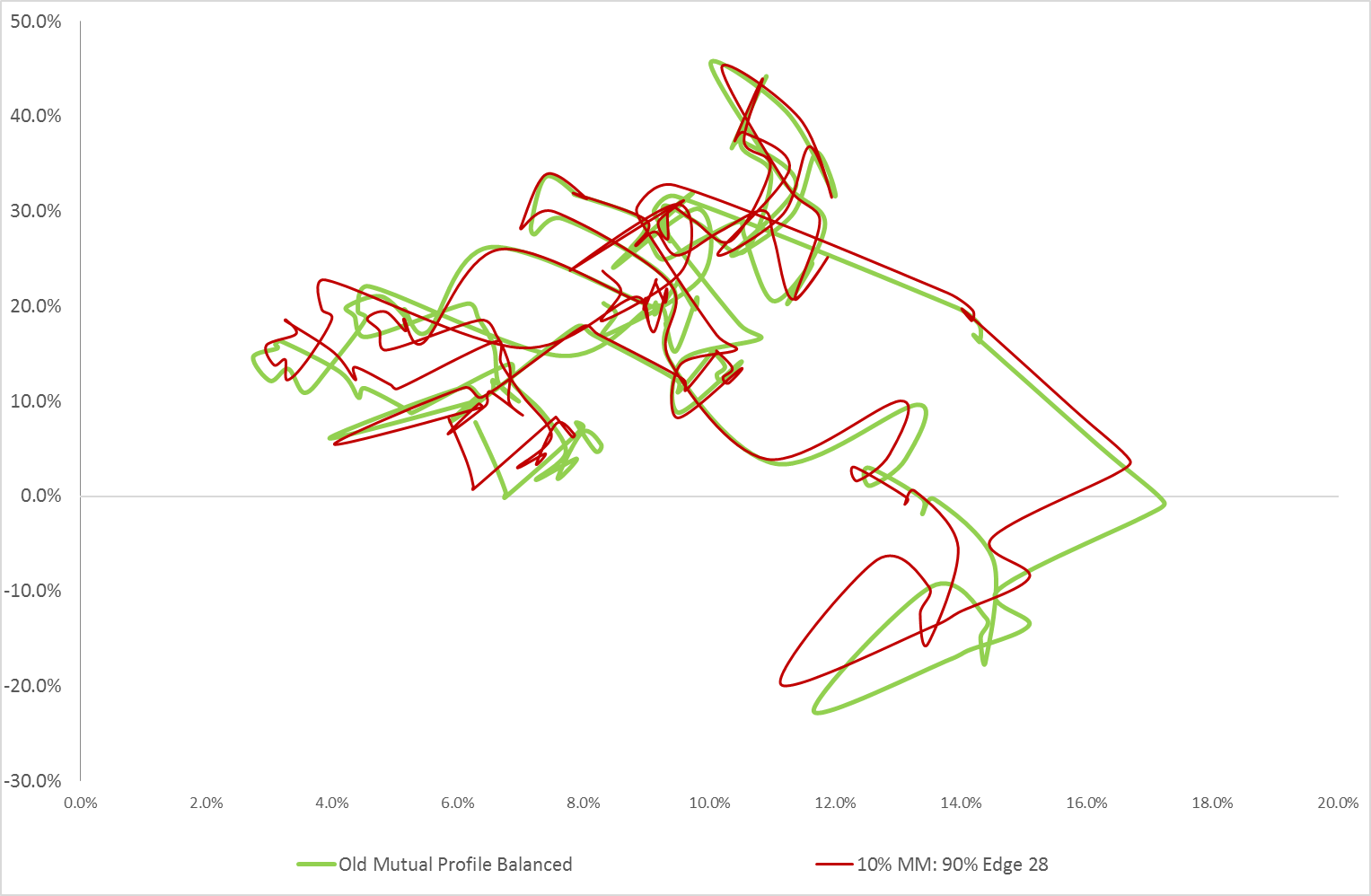

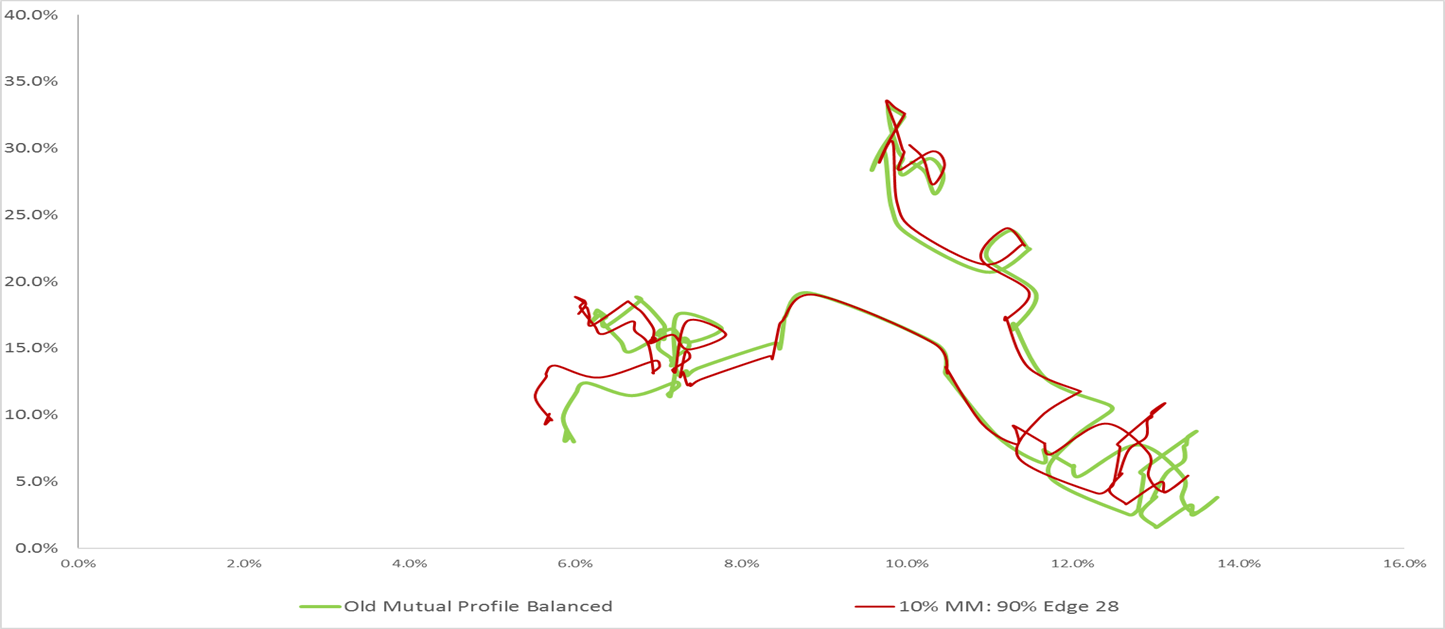

Historic Analysis: Historic analysis shows close correlation in both returns and volatility between the Selected Combination and the OMIG Profile Balanced portfolio over rolling 12-month and 3-year periods. The graphs below provide illustrations of this analysis. This analysis was conducted by Sukha & Associates (Pty) Ltd, the independent investment consultants appointed by OMEGS.

Rolling 12-month returns: June 2003 to January 2017

The rolling 12 month returns of the Selected Combination (90% OMIG Profile Edge28 + 10% Old Mutual SA Money Market Pooled Portfolio) closely tracked those of the OMIG Profile Balanced portfolio over the review period. The same applies for rolling 3 year returns (not depicted here).

Rolling 12-month “Snail Trail”: June 2003 – January 2017

The rolling 12-month returns of the Profile Balanced and the Selected Combination (90% OMIG Profile Edge28 + 10% Old Mutual SA Money Market Pooled Portfolio) are plotted on the y axis, and the rolling 12-month volatility is plotted on the x axis. The Selected Combination has a very similar risk-return profile to the OMIG Profile Balanced portfolio, although with slightly better returns during negative 12-month periods.

Rolling 36-month “Snail Trail”: June 2003 – January 2017

The rolling 36-month returns of OMIG Profile Balanced and the Selected Combination are plotted on the y axis, and rolling 36-month volatility is plotted on the x axis. This 3-year Snail Trail reflects that the Selected Combination provided similar, if not slightly better, risk-return outcomes in aggregate than the Profile Balanced portfolio over the period considered.

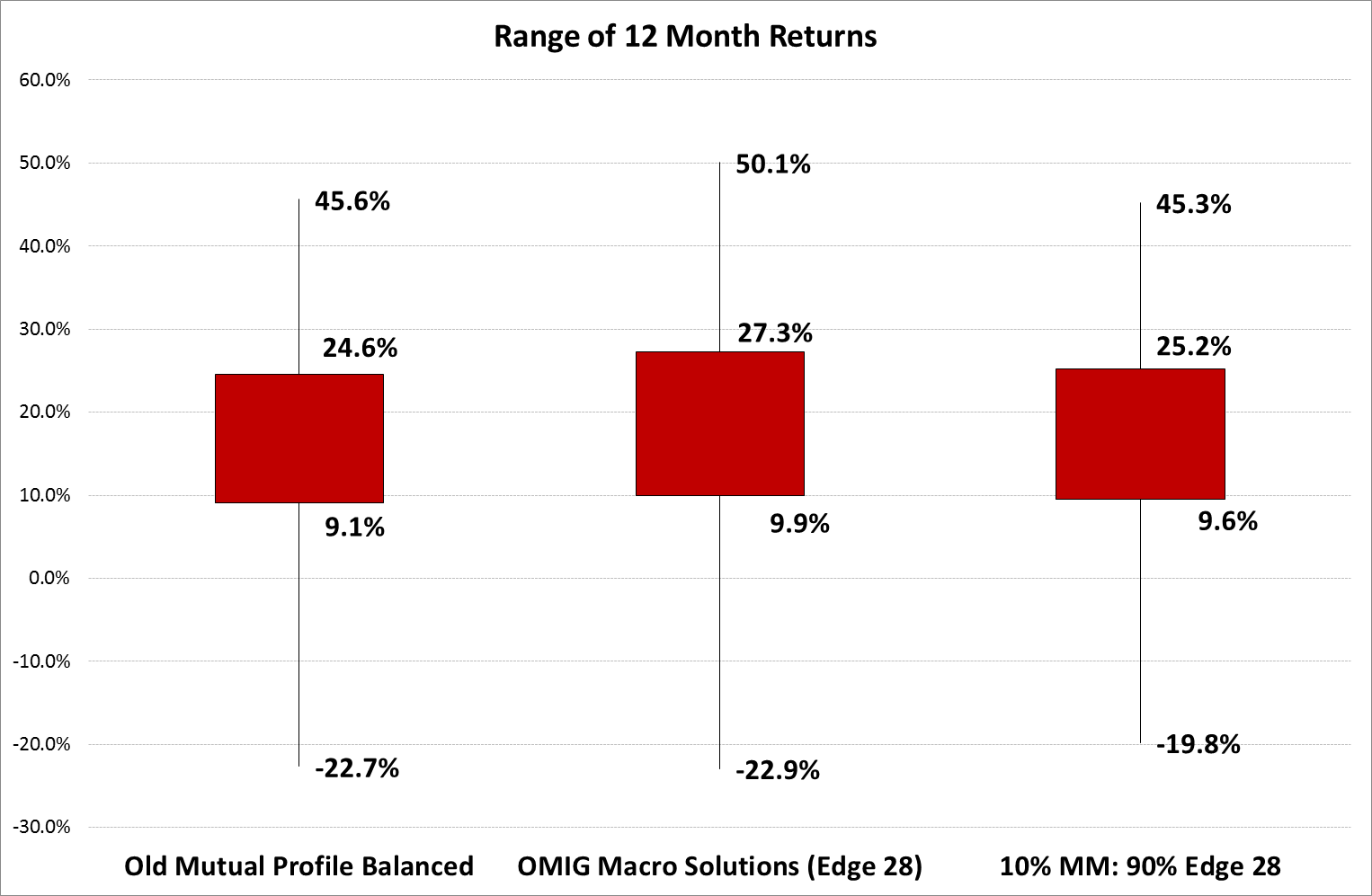

Range of 12-month Returns over the period June 2003 to January 2017

The chart above shows the range of returns over any 12 months for the period June 2003 to January 2017. The chart reflects slightly better outcomes for the Selected Combination during negative periods relative to the OMIG Profile Balanced portfolio i.e. the worst 12 month return for the Selected Combination was -19.8% vs -22.7% for the OMIG Profile Balanced portfolio. 75% of 12-month returns from Profile Balanced were greater than 9.1%, while 75% of 12-month returns from the Selected Combination were greater than 9.6%. The OMIG Profile Edge28 portfolio is included for comparison.

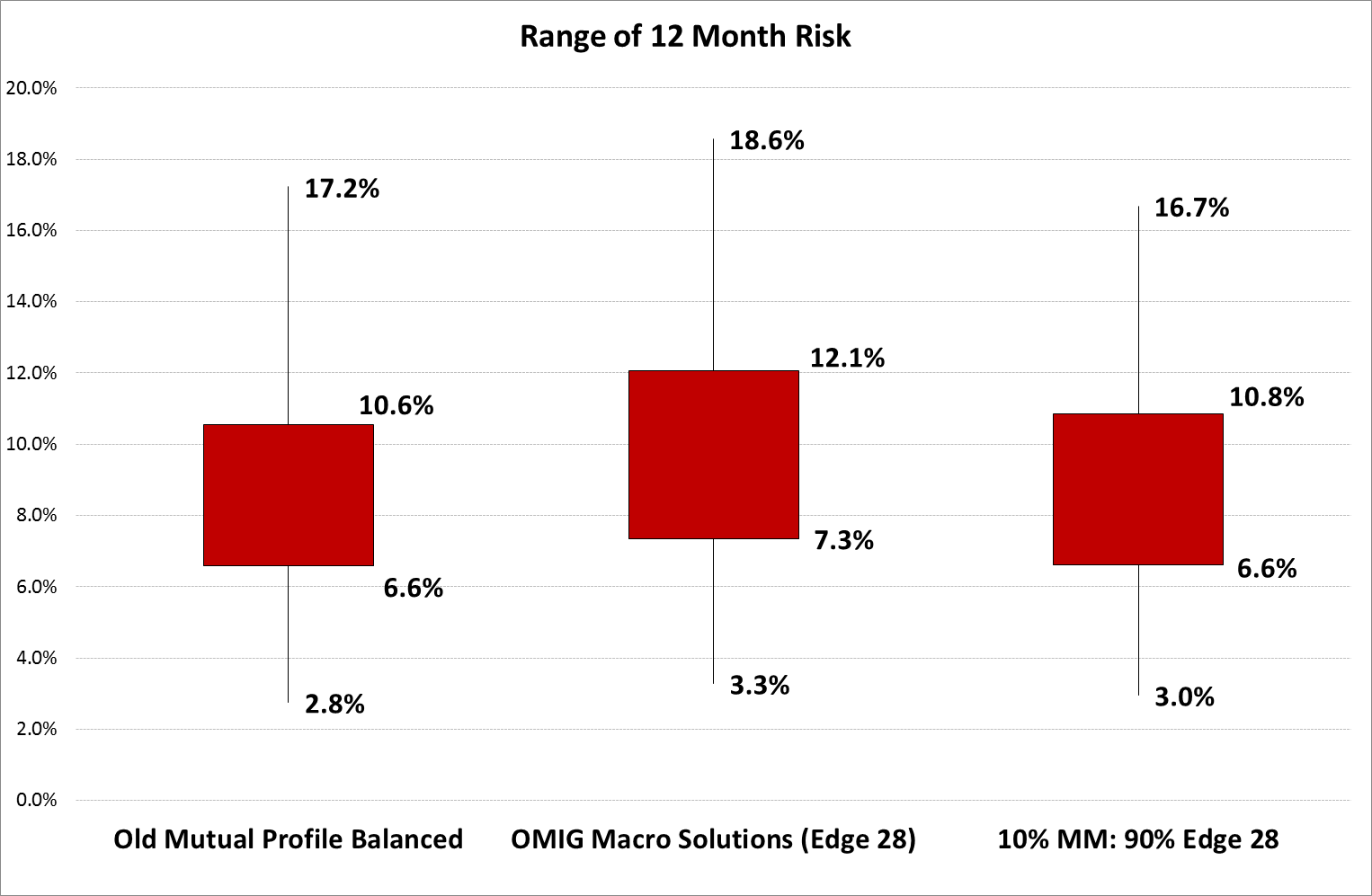

Range of 12-month Volatility over the period June 2003 to January 2017

The chart above shows the range of volatility over any 12 months for the period June 2003 to January 2017. The chart reflects similar 12 month volatility outcomes for OMIG Profile Balanced and the Selected Combination. The OMIG Profile Edge28 portfolio is included for comparison.

Fee Comparison: The effective investment management fee for the Selected Combination is also closely matched to that of the OMIG Profile Balanced portfolio. The typical combined investment management fee for the Selected Combination is estimated at 0.564% p.a., which is only 0.05% higher than that of OMIG Profile Balanced.

PRACTICAL CONSIDERATIONS

- You can make a switch at any time in the month, and it will usually be completed within 3 to 5 working days. There is no cost to make an investment switch.

- Please ensure that you switch both your existing balance in OMIG Profile Balanced AND update your election regarding where future contributions are invested.

- Should you be considering a switch into the Absolute Smooth Growth or Absolute Secure Growth portfolio, please ensure that you are familiar with how the AGP portfolios work. It is important that you understand how the bonus smoothing reserve works, the current level of the bonus smoothing reserve, how the bonus declaration formula is used to smooth returns over time, and the potential for market value adjustments. A financial adviser can assist you in this regard.

- You can make the switch online via Secure Services, or by using the attached Investment Fax Form. The SuperFund Member Service Centre (0860 20 30 40) will be happy to assist with any queries you have about how to implement an investment switch.

- You can find switching guides on the OMEGS website. These guides provide a step-by-step outline of how to switch your existing Member Account Balance and how to redirect your future contributions.

- You can expect to receive a switch certificate (sent to the email/contact address you provided) within 5 days from the date that your switch was processed. If you do not receive a certificate after implementing a switch instruction, or if you have any queries, please contact the Fund’s Member Service Centre on 0860 20 30 40 or email superfund@oldmutual.com