INVESTMENTS

Your Member Account Balance needs to be invested to grow over the long term, so that you can benefit from the power of compound interest. It is important to have a long-term investment strategy which targets growth well in excess of inflation; otherwise you are unlikely to be able to save enough to provide for your needs in retirement.

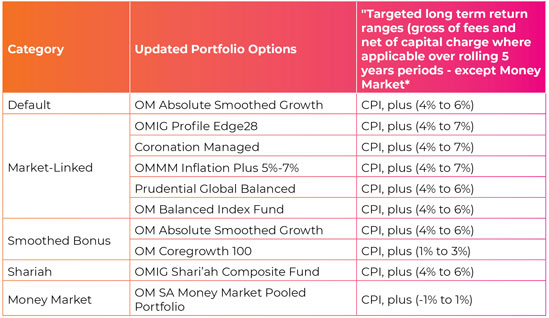

- The OMEGS section in SuperFund provides members with an excellent default option, because many members are not completely confident when making investment choices. This JMC Choice default option is a good “one-size-fits-all” investment appropriate for the needs of the majority of OMEGS members. If you don’t actively make an investment choice, you will be invested in the JMC Choice option, the Old Mutual Absolute Smooth Growth Portfolio.

- If you want to tailor-make your investment strategy, you can choose from any one or more of the 9 carefully selected investment portfolios on offer.

- You will pay the relevant investment management fees on the investment(s) you select.

- Please make sure you understand the potential for Market Value Adjuster (MVA) if you switch out of the Old Mutual Absolute Smooth Growth Portfolio or the Old Mutual Absolute Secure Growth Portfolio. You can read more about this in the section “Understanding the Absolute Growth Portfolios (AGP) and Market Value Adjustments” below.

*Money Market targets returns over rolling 3 year periods.

** The targeted long-term return targets for all of the non-smooth bonus portfolios are the midpoints of the ranges specified above. The smooth bonus portfolios have their official targets (gross of fees and net capital charges) reflected as the maximum targeted return with the minimum targeted return being 2% lower.

There are two types of investment transaction available:

- Switches: this is when you switch part or all of your Member Account Balance from its current investment portfolio to another investment portfolio/s.

- Investment Elections: this is when you elect to invest your future Fund contributions in another investment portfolio/s. There is no cost for making investment elections.

It is important to note that these are two separate transactions.

- If you’d like to make an investment switch, the best way to do this is online, using Secure Services.

- We recommend that you use the Microsoft Internet Explorer web browser, since the Secure Services website is optimised for this browser.

- You can read our guides to find out how to make a switch:

- If you need help on how to switch part or all of your Member Account Balance to other portfolios, check out the Member Account Balance Switching Guide.

- If you need help on how to change where your future contributions are invested, check out the Investment Election Guide.

- If you DON’T have access to Secure Services, you can use the fax form: SuperFund Customised Investment Switch Form

To find out more about Book Value and Market Value switches (for members invested in the Old Mutual Absolute Smooth Growth Portfolio or Coregrowth 100 Portfolio), please see the section “Understanding the Smooth Bonus Portfolios and Market Value Adjustments” below.

Historic Investment Performance summaries

Fact sheets updated as and when available from investment managers. View the latest quarterly PDF fact sheets for each of the investment portfolios offered by the Fund:

- Old Mutual Absolute Smooth Growth Portfolio (JMC Choice)

- OMIG Profile Edge28 Portfolio (Previously named Profile Pinnacle)

- Coronation Managed Portfolio

- OMMM Inflation Plus 5-7 Portfolio

- Prudential Global Balanced Portfolio

- Old Mutual Balanced Index Fund

- Old Mutual Shariah

- Old Mutual SA Money Market Portfolio

- Old Mutual Coregrowth 100

PLEASE NOTE: The Investment Performance Summary is updated monthly and uploaded to the OMEGS website approximately 3 weeks after month-end. Fact sheets are updated as they become available and as a result the period reflected on the website may differ per portfolio.

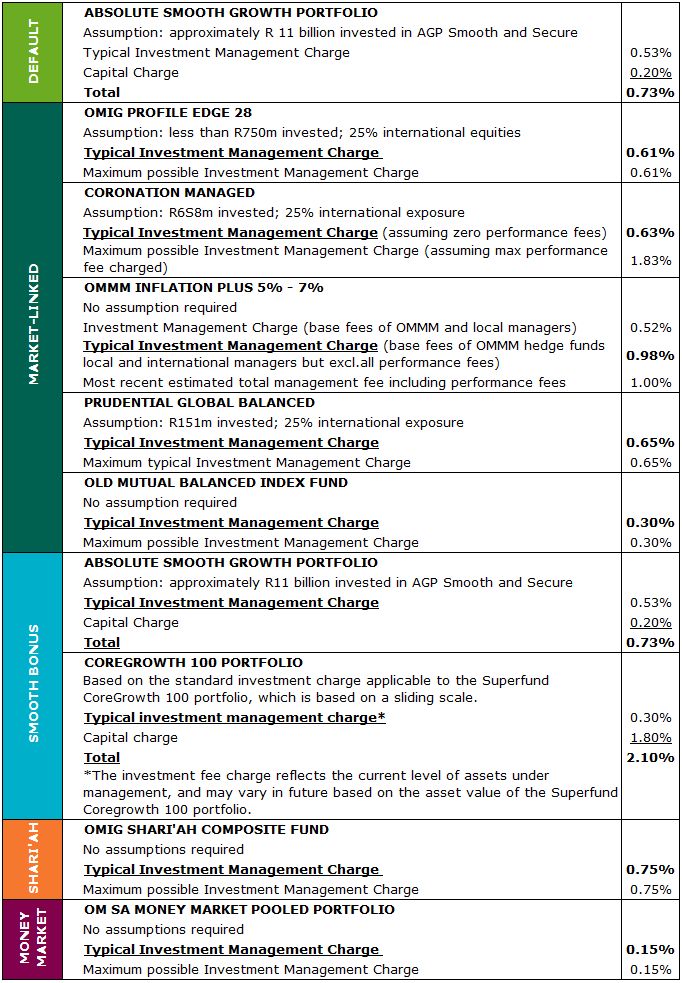

Typical investment fees

The table below gives typical investment management fees, based on a set of assumptions – please note that these are not the exact fees charged, but just an example of what the fees might be in a given scenario.

Investment fee examples

Based on the table of typical investment management fees set out above, it is possible to provide a few examples of how the investment management fees would impact on your retirement savings. Note that all of these fees may vary if the assumptions set out in the table above differ, although it is not expected that fees will be significantly different to those set out above.

Example 1: A member fully invested in Old Mutual Absolute Smooth Growth

- If you chose to invest your full Member Account Balance in the Absolute Smooth Growth Portfolio, then your retirement savings would incur a total investment fee of approximately 0.73% per year, taking into account all investment-related fees including the capital charge.

- Put differently, if you have a Member Account Balance of R100,000, then investment fees will reduce your investment return by R730 per year.

- (Note that the capital charge of 0.2% is deducted before the declaration of the bonus (investment return) each month. This means that, if you want to compare the net-of-fees investment return of the Absolute Smooth Growth Portfolio against another portfolio, you should only deduct the Investment Management Charge plus the Administration Charge (i.e. a total of 0.53%) from the Absolute Smooth Growth Portfolio’s return.)

Example 2: A member fully invested in Coronation Managed

- If you chose to invest your full Member Account Balance in the Coronation Managed portfolio, then your retirement savings would incur an investment management fee that could range between 0.63% and 1.83%. The fee depends on whether the Coronation portfolio outperforms its benchmark (target) – if it does not outperform the targets at all, then the fee would be 0.63%, but if it does extremely well then the fee could be as high as 1.83%.

- Put differently, if you have a Member Account Balance of R100,000, then investment fees will reduce your investment return by between R630 and R1,830 per year.

Example 3: A member invested with a 50/50 split between OMIG Profile Edge28 and Prudential Global Balanced

- If you chose to invest half of your Member Account Balance in OMIG Profile Edge28 and half in Prudential Global Balanced, then your retirement savings would incur an investment management fee based on the combination of these products’ fees. The total investment management fee would be approximately 0.63% per year.

- Put differently, if you have a Member Account Balance of R100,000, then investment fees will reduce your investment return by approximately R630 per year.

Example 4: A member fully invested in Old Mutual Coregrowth 100 Portfolio

- If you chose to invest your full Member Account Balance in the Coregrowth 100 Portfolio, then your retirement savings would incur a total investment fee of approximately 2.1% per year, taking into account all investment-related fees including the capital charge.

- Put differently, if you have a Member Account Balance of R100,000, then investment fees will reduce your investment return by R2,100 per year.

- (Note that the capital charge of 1.8 % is deducted before the declaration of the bonus (investment return) each month. This means that, if you want to compare the net-of-fees investment return of the Coregrowth Portfolio against another portfolio, you should only deduct the Investment Management Charge plus the Administration Charge (i.e. a total of 0.3%) from the Coregrowth Portfolio’s return.)

For Investment Choice and OMEGS-related queries, contact the Member Service Centre on 0860 20 30 40.

If you would like to get in touch with an accredited Old Mutual financial adviser, you can find contact details here.

INTRODUCTION TO THE ABSOLUTE GROWTH PORTFOLIOS (AGP)

- The Old Mutual Absolute Smooth Growth Portfolio is the default investment portfolio selected by the OMEGS Joint Management Committee for members who don’t make an active investment decision. It provides smoothed returns and a 50% guarantee. AGP Smooth is a good “one-size-fits-all” investmentappropriate for the needs of the majority of OMEGS members.

- The Old Mutual Coregrowth 100 Portfolio offers a 100% guarantee (on benefit payments). However, there is a capital charge of 1.8% p.a. charged for the 100% guarantee. Additionally, the underlying assets are more conservatively invested relative to the AGP Smooth Growth Portfolio.

- The AGP range uses enhanced smoothing technology to grow retirement savings while protecting investors from the risk of volatile markets. The returns that are earned by the investments underlying the AGP portfolios are smoothed over time through bonuses that are declared monthly in advance. AGP’s assets are invested in an aggressive balanced portfolio which comprises both local and global equities, interest bearing assets, property and alternative investments. Smoothing is a process used to deliver long-term returns to investors in a predictable and stable way. This protects members from the short-term volatility and uncertainty that is often associated with investing in market-linked balanced funds.

- AGP delivers bonuses which are calculated using a simple and transparent formula with a CPI related target as the main focus. The formula smooths growth over time and reduces the impact of market ups and down on the members investment value. The long-term return earned on the portfolio is expected to be approximately equal to that of a similarly managed market-linked portfolio (net of capital charges).

AGP: BONUS SMOOTHING RESERVE AND INVESTMENT ACCOUNT

- The investment returns earned on AGP assets are credited to a Bonus Smoothing Reserve (BSR), from which bonuses are declared. The BSR is the difference between the market value of the underlying AGP investments and the total smoothed Investment Account values of all members invested in the portfolio. The BSR is targeted in the long term to be within a range of 0% to 5% of the total smoothed Investment Account values of all members invested in AGP. However, the smoothing process, coupled with short-term market movements and the impact of cash flows, does mean that BSR moves outside of this range at times.

- A member’s Investment Account value is the value of the capital the member has invested in the fund plus all bonuses declared to date less any unit disinvestments.

Book Value Switches (also known as Investment Account Switches):

- Allowed at the investment account value twice a year, on 01 October and 01 April. A minimum of 3 months’ notice for these switches is required, i.e. a completed switch form or online switch must reach Old Mutual at least 3 months before the switch date.

- There is an annual limit to this Book Value Switch facility to protect investors in these portfolios in adverse market conditions when the Bonus Smoothing Reserve is negative.

- If you want to switch on any date other than the two dates specified above, a Market Value Switch can be processed.

Market Value Switches (also known as Market Account Switches):

- Allows you to switch from one of the Absolute Growth Portfolios at any point at investment account value less a market value adjuster when applicable.

- The purpose of the Market Value Adjuster (MVA) is to protect the policyholders remaining in the fund.

- An MVA is applied when the market value of the assets are less than the investment account value.

- The MVA is expressed as a percentage (%) of the investment Account, so the amount switched is reduced by Investment Account Amount x MVA%.

- Old Mutual retains ultimate discretion on the level of an MVA.

- Your estimated switch value can be obtained by calling the Old Mutual Member Servicing Centre on 0860 20 30 40.

Example A: MVA = 0%; Investment Account = R1000. Member wants to switch all his money to another fund. Investment Account reduces by 0% and R1000 is switched.

Example B: MVA = 5%; Investment Account = R1000. Member wants to switch all his money to another fund. Investment Account reduces by 5% and only R950 is switched.

AGP: FREQUENTLY ASKED QUESTIONS

WHAT IS A MARKET VALUE ADJUSTMENT (MVA)?

A Market Value Adjustment (or MVA) is an adjustment which is made to a member’s investment account value when the market value of the assets underlying their investment falls below their investment account value. The adjustment is applied to bring the investment account value in line with the value of the assets underlying their investment. The MVA is only applied if members choose to voluntarily take their money out of an investment portfolio via a market value switch.

WHY WOULD AN MVA BE APPLIED?

Periods of poor market performance may cause the returns earned on the AGP investment portfolios to fall below the bonuses declared on these portfolios. As a result, the value of the assets underlying a member’s investment may fall below their investment account value.

An MVA is applied if a member chooses to voluntarily switch their money out of an AGP investment portfolio while the value of the assets underlying their investment is below their investment account value. An MVA is applied to bring the member’s investment account value in line with the value of the assets backing their investment.

WHAT DOES AN MVA ACHIEVE?

By bringing the investment account value of a member voluntarily switching out of an AGP investment portfolio in line with their share of the value of the investment portfolio’s assets, an MVA protects the interests of those members who remain in the investment portfolio by ensuring that the bonus smoothing reserve (BSR) is not unduly reduced by investors that choose to voluntarily exit the investment portfolio.

If this adjustment was not in place, the value paid to a member voluntarily exiting the investment portfolio could be too high and could mean that those members that remain receive future bonuses that would be too low.

An MVA is a temporary measure which is dependent on market conditions and does not benefit Old Mutual’s shareholders. An MVA is a temporary measure that is removed when markets recover and the value of the assets backing members’ investments catches up to their investment account values.

WHEN WILL AN MVA APPLY?

An MVA will only apply when a member chooses to voluntarily switch their money out of an AGP investment portfolio while the value of the assets underlying their investment is lower than their investment account value. An MVA will not apply to members remaining invested in the investment portfolio, or to members exiting the investment portfolio due to defined benefit events (such as resignation, termination of employment, retrenchment, retirement or death).

DOES MY GUARANTEE PROTECT ME FROM THE MVA IN ANY WAY?

Guarantees do not protect the value of your benefit when you choose to voluntarily take your money out of an AGP investment portfolio via a switch. The impact of an MVA is thus not restricted by the guarantee.

Guarantees protect members by ensuring that they receive a minimum benefit amount on certain benefit payments only (such as resignation, termination of employment, retrenchment, retirement or death). MVAs do not apply to these benefit payments in any way.

HOW DO I ENSURE THAT MY OMEGS SAVINGS ARE NOT ADVERSELY AFFECTED BY AN MVA?

To ensure that your investments are not impacted by an MVA and that you continue to benefit from the smoothed investment growth of the Old Mutual Absolute Growth Portfolios, make sure that you don’t implement a Market Value switch out of an AGP investment portfolio at a time when an MVA is applicable. Members should keep a long-term view in line with their investment plan as the investment portfolio is designed to deliver strong growth in the long term despite short-term volatility.

You can also make a Book Value switch (Investment Account switch) to avoid the impact of a market value adjuster. Book Value switches can only be made twice a year, on 01 April and 01 October each year. You must apply for a Book Value switch at least 3 months before those dates, i.e. 31 December and 30 June respectively. Once you have elected a Book Value switch, you will not be able to cancel this during the three months to the actual switch date.

Remember, the MVA is a temporary measure which is dependent on market conditions and it only impacts those members who choose to exit the investment portfolio voluntarily via a market value switch while the MVA is in effect. Members receiving benefit payments (e.g. on resignation, termination of employment, retrenchment, retirement or death) are NOT affected by the MVA, and will continue to benefit from smoothed investment growth at the time when they need it most.

What factors should influence my investment strategy?

When choosing an investment strategy, there are a range of issues that will influence your decision. It is advisable that you think about the following points:

- How familiar you are with investment matters. If you have a lot of experience in the investment world then you will probably feel confident enough to create your own investment strategy. But if you are not comfortable with investing, you will need to research before changing from the default JMC Choice portfolio. This will ensure that you choose an investment strategy which suits your specific needs. Remember, if you have the wrong investment strategy you could lose a lot of money.

- The length of time your investments will remain invested. Even if you are thinking about leaving employment soon, you should keep in mind that those assets represent your retirement savings. Your intended date should therefore determine your investment horizon. So, if you decide to leave the Fund before you retire, you will have the chance to preserve your benefit by using the Preserver option, or transferring it to another retirement or preservation fund.

- What do you intend to do with the proceeds of your benefit, either at retirement or at earlier withdrawal? Members should match their pre-retirement investment choices with their intended pension (annuity) and investment choices. This means that if you are close to retirement you should carefully consider what kind of pension (annuity) you are likely to select when you retire. You should then try to match your investment strategy in the Fund to your post-retirement plans. A professional financial adviser may provide valuable assistance here.

- Your personal tolerance for risk. In this context, ‘risk’ means negative returns. The higher the exposure to equities, the most volatile asset class, the higher the probability of negative returns in the short term. However, this risk is counter-balanced by a higher probability of stronger performance in the longer term. If you are willing to take more risk (i.e. greater probability of negative returns in the short term) you are likely to be rewarded in the longer term by higher returns. If you decide on a more conservative option, your annual returns will be more stable but your longer-term performance is likely to be significantly lower.

Your investment risk profile will be determined by the above aspects. It will also be influenced by such personal factors as your other provision for retirement, your health, the age of your dependants (should you have any) and your financial expectations after retirement.

Balancing risk and return

Two of the major risks to consider when it comes to investing are:

- The risk that your investment value falls because investment markets experience a downturn. (This risk is often called volatility).

- For example, if you were to invest R1,000 in a risky (volatile) investment with lots of potential, but investment conditions changed and the value of this investment fell by 10% just before you sold the investment – then you would only have R900.

- The risk that you don’t earn sufficient investment return over your investment lifetime, so that you have too little to money when you retire.

- For example, if you hid your R1,000 under the mattress, you wouldn’t earn any investment growth, even if you know that the money is safe there.

- However, remember that inflation eats away at the value of your money all the time. This means that after a year’s time, your money under the mattress may only be worth R950 in real terms, and after another year only R900…

- In fact, to retire comfortably, you need to earn an investment return of MORE than inflation – because you need to benefit from the power of compound interest to make your money GROW!

The challenge is therefore to find the right investment strategy that protects you against major falls in value, while still providing you with sufficient investment growth. OMEGS offers members three specific categories of investments, as well as a “JMC Choice” category which provides a very good option for members who are not confident in making investment decisions. See the “Investment Options” section above for more detail.

All members are strongly advised to seek the guidance of a professional financial adviser before making any decisions. Your adviser will complete a full needs and risk analysis before giving you advice.

The OMEGS JMC has put in place a comprehensive Customised Investment Plan, which summarises the investment strategy of OMEGS. The OMEGS investment structure is based on a system of Member Level Investment Choice. Members are able to choose a portfolio or combination of portfolios, into which they would like to invest their retirement monies. The JMC is responsible for the selection of the investment portfolios available to members and the selection of the underlying managers. The JMC must also select the JMC Choice Portfolio, which is the default portfolio available to members of OMEGS.

The JMC has also put in place a Sub-Fund Responsible Investing Policy. The core objective of the Sub-Fund Responsible Investing Policy is to act in the best interests of the OM membership by recognising that ESG (Environmental, Social and Governance) factors can influence both investment risk and return, and must therefore be considered by the JMC in the investment decision-making process. Protecting and enhancing financial returns by incorporating such factors is consistent with fiduciary duty.

A copy of the OMEGS Customised Investment Plan and the Sub-Fund Responsible Investment Policy are available to members on request. To obtain a copy of either document, please send an email to superfund@oldmutual.com and request the document from the Joint Management Committee.