How do you know whether you are on track for retirement? If you’re getting closer to retirement, you may not really want to know the answer, in case it scares you. And if you’re still far from retirement, you may think it’s not really important right now. But wherever you are on the journey, knowing your Retirement Planning Status can equip you to make better decisions and take appropriate action. Your Retirement Planning Status provides you with an indication of how “on-track” you are for a comfortable retirement.

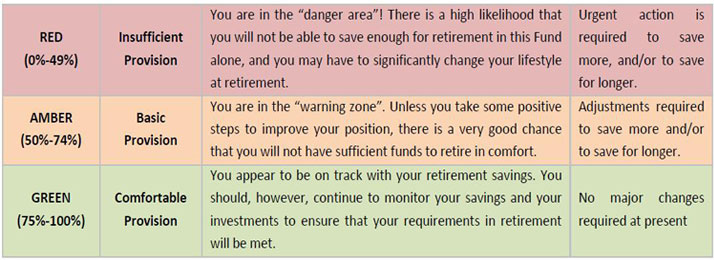

All this information is available in your latest Member Benefit Statement. If you haven’t seen yours, check it out on Secure Services. In your Benefit Statement, we’ve colour-coded your Retirement Planning Status to give you a quick indicator of how “on-track” you are for a comfortable retirement. This table provides an idea of what we mean:

Retirement Planning Status – Red, Amber or Green?

Your Retirement Planning Status is calculated using a measure called a Replacement Ratio (sometimes abbreviated as “RR”). It can be calculated as your Projected monthly pension at retirement divided by your Projected monthly salary at retirement.

For example: if our friend Average Joe has pensionable earnings of R10,000 a month just before he retires, a Replacement Ratio of 65% would mean that he will receive a pension of R6 500 per month (65% of R10 000) in his retirement.

A couple of important things to note:

- The Replacement Ratio that you require at retirement may be very different from that which your colleagues require, because it will depend on your personal circumstances. However, if you want to retire comfortably, you will probably need a total savings pool which will give you a pension after retirement that is at least 75% of your income just before retirement.

- We do not know anything about other money or investments you may have saved towards your retirement, so we have based our analysis ONLY on your savings in this Fund.