HOW DO I MAKE A CHANGE?

FIELD STAFF: (i.e. Employees whose earnings include a commission component)

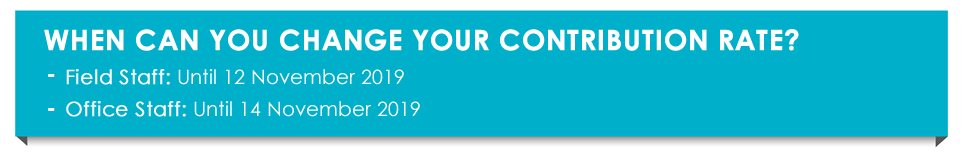

- Field/Sales Staff can change their contribution rate until 12 November.

- To change your contribution rate, please complete and submit the Retirement Contribution Election Form (Field Staff).

OFFICE STAFF: (i.e. Employees who are on a TGP structure)

- Office Staff can make changes to their contribution rate until 14 November on Oracle HRMS by following the steps below.

- Step 1: Log on to Oracle HRMS and select My Self Service (ZA)

- Step 2: Click on Remuneration Package Structuring and select Remuneration Package Structuring again

- Step 3: Select Update Benefits and choose the % contribution you want to contribute (Retirement Selection Employee). Note that the Employer contribution of 3.5% will be added to your Employee contribution.

- Step 4: Click on the Submit button and then the Finish button to ensure that your choice has been saved. A confirmation message will appear on the screen.

THE POWER OF 0.5%

We know that increasing your contribution rate isn’t easy, especially when times are tight! But even a small change can make a big difference. For example, try to increase your retirement contribution each year by 0.5%. Over the long term the impact is huge!

EXAMPLE: Thato, with a TGP of R10 000 per month

- Each year at pay review time, Thato increases his OMEGS contribution rate by 0.5%, and he does this for the next 10 years. After 10 years, his contribution rate is 5% higher than it is at present. Thereafter, he keeps his contribution rate level.

- After 10 years, Thato’s savings would be equivalent to R40,700 higher in today’s Rand value than they would have been if he had not made the increases.

- After 20 years, Thato’s savings would be equivalent to R154 200 higher in today’s Rand value.

- After 30 years, Thato’s savings would be equivalent to R350 900 higher in today’s Rand value.

- After 35 years, Thato’s savings would be equivalent to R496 700 higher in today’s Rand value.

- By simply increasing his contribution rate by 0.5% each year for the next 10 years, Thato would have saved an extra 4.1 times his annual TGP after 35 years!

- Best of all, Thato’s extra R496 700 after 35 years would have cost him less than R175 500 in terms of take-home pay (all in today’s Rand value). This is because of the benefits of compound interest and tax deductions.

Note: these calculations are for illustrative purposes only, and are based on a set of assumptions which may not play out in future.

You can read more about how your contributions work by clicking here.